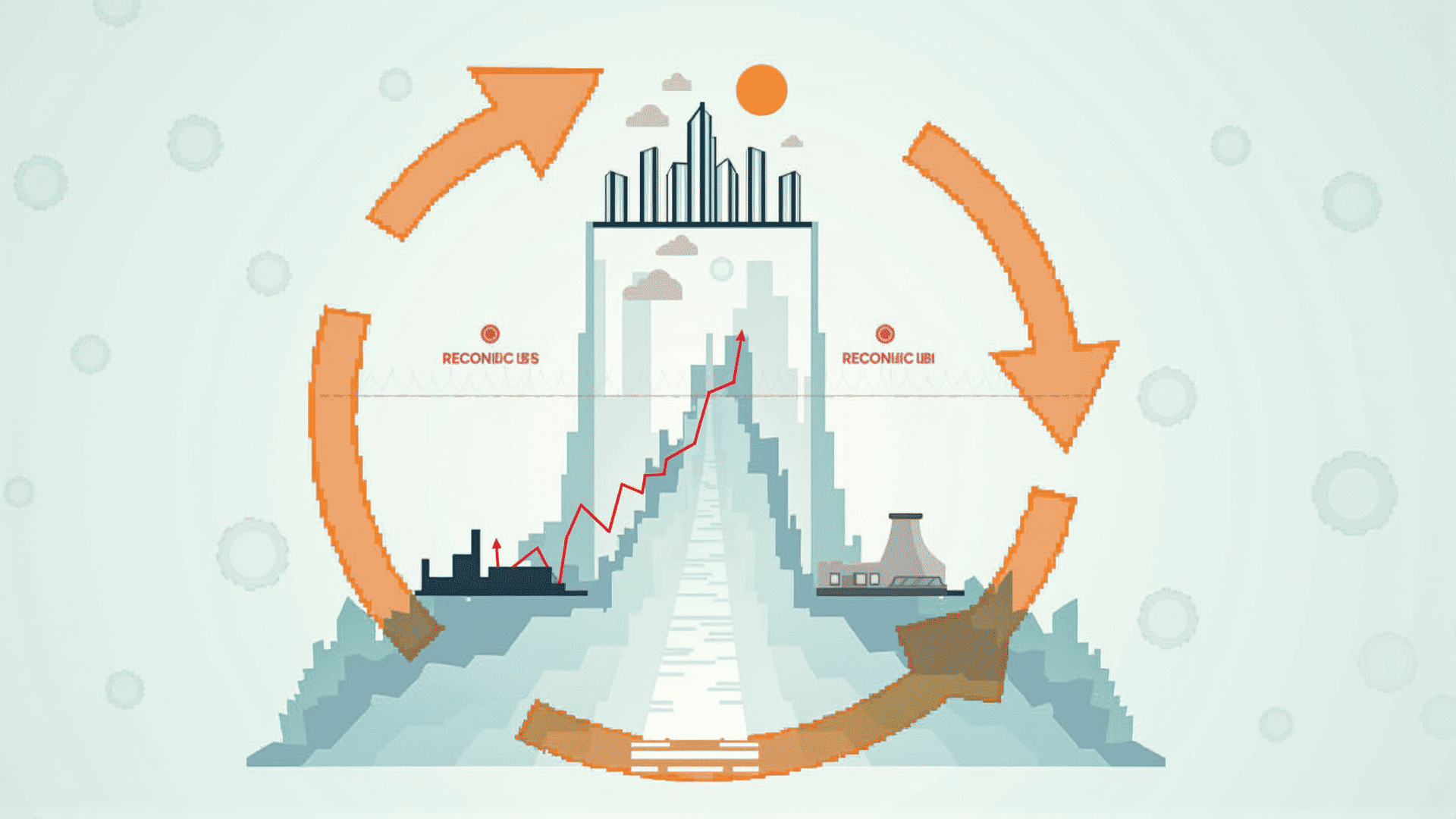

Understanding the ebb and flow of economic cycles provides valuable insights into the factors that influence the prosperity and challenges of markets. These cycles, consisting of periods of expansion and contraction, are driven by a variety of interrelated forces that can significantly impact businesses, individuals, and governments.

Economic growth phases typically manifest as periods of increasing productivity, employment opportunities, and consumer confidence. During these times, economies generally experience higher outputs and improved living standards. This phase can be sparked by technological innovations, favorable government policies, or increased consumer spending. Businesses may expand operations, hire more staff, and invest in new projects, further fueling the cycle.

Conversely, periods of contraction bring about reductions in economic activity. These downturns can result from factors like shrinking consumer demand, rising interest rates, or geopolitical tensions. During these times, companies might reduce their workforce, and the focus often shifts to maintaining stability and cost-efficiency.

Understanding these patterns requires attention to various indicators such as gross domestic product (GDP) growth rates, consumer confidence indexes, employment levels, and production output. Monitoring these metrics can help anticipate transitions from one phase to another, allowing for more informed decisions.

A vital aspect of navigating these cycles is recognizing the external shocks that can disrupt normal patterns. Natural disasters, global health crises, or major geopolitical shifts can alter the expected trajectory, creating rapid and sometimes severe impacts that require quick adaptation.

To mitigate the adverse effects of economic downturns, it is crucial for policymakers to implement strategies that maintain stability. Measures may include adjusting interest rates, altering taxation, or enacting fiscal policies aimed at stimulating activity.

In summary, understanding economic cycles enables individuals and organizations to prepare and respond to the ongoing changes within markets. By analyzing patterns and indicators, we can better anticipate shifts and create robust strategies for both growth and resilience.