Economic cycles are a fundamental aspect of how societies operate, shaping various aspects of our lives from job stability to how we manage our household budgets. Understanding these cycles can empower individuals to make informed decisions about their finances, helping them navigate through periods of growth and contraction with greater ease.

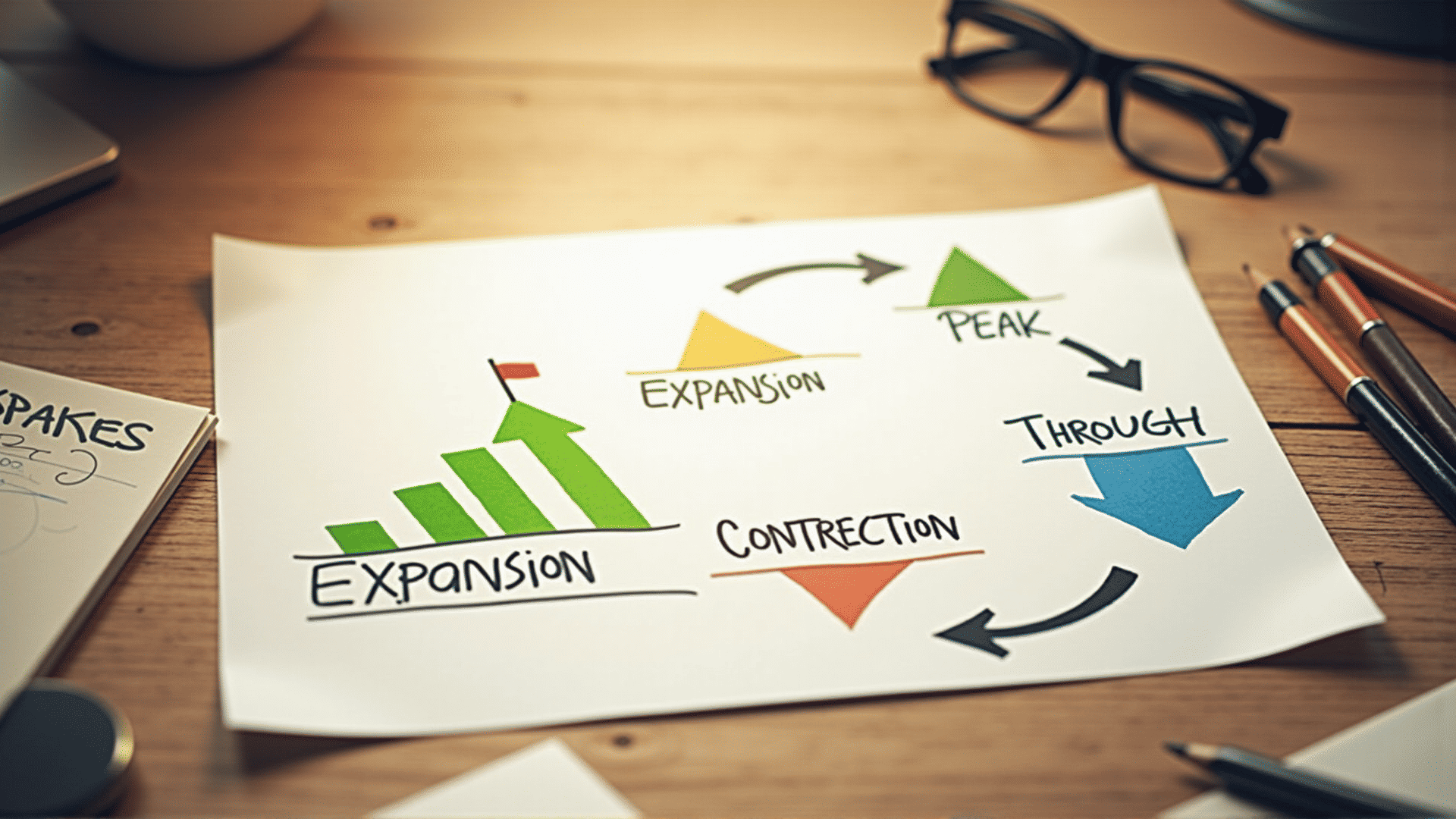

An economic cycle refers to the fluctuations in economic activity that an economy experiences over a period of time. It is typically characterized by four distinct phases: expansion, peak, contraction, and trough. Each phase affects different segments of society in unique ways, influencing employment, consumer behavior, and ultimately, individual financial decisions.

During the expansion phase, economic activity is on the rise. This period is often marked by increasing employment opportunities, rising consumer confidence, and overall growth in economic output. For individuals, this might mean a time of relative financial security, where job prospects are plentiful and incomes may be rising. It serves as an ideal period to save and build up financial reserves in preparation for less prosperous times.

When the economy reaches its peak, growth rates level off, and the economy stops expanding. This stage can be a critical time to evaluate personal financial situations. Maintaining a budget that allows for savings is important, as it ensures individuals are prepared for the potential downturn that usually follows.

The contraction phase, often referred to as a recession, brings a decline in consumer spending and economic activity. Job losses may occur, and financial resources can become strained. During this time, individuals often need to tighten their budgets, focusing on essential spending and avoiding unnecessary expenditures. It's a period where having followed a disciplined savings plan during previous phases can provide much-needed relief.

Finally, the trough is the stage where the economy starts recovering from the contraction. It offers a time of adjustment and an opportunity to reassess financial habits. As the economy begins to recover, individuals can start planning for future opportunities and reconsider long-term financial goals.

Incorporating an understanding of economic cycles into daily life involves recognizing the signs of each phase, anticipating their potential impacts, and adjusting personal financial strategies accordingly. Whether it is saving during times of growth or conserving resources during downturns, being aware of these cycles allows for proactive fiscal management.

The interplay of economic cycles with personal finance extends beyond mere technical adjustments. It influences psychological aspects of financial behavior as well. For example, during expansions, maintaining a prudent approach prevents overconfidence that could lead to impulsive financial decisions. Conversely, in contractions, understanding that economic downturns are cyclical can alleviate undue stress and encourage a more measured response to financial challenges.

In conclusion, economic cycles are an inevitable part of how economies function and have significant implications for personal financial management. By understanding and anticipating these cycles, individuals are better equipped to adjust their financial strategies and make informed decisions. This awareness not only provides a buffer against economic uncertainties but also enables people to leverage periods of growth effectively, ensuring long-term fiscal well-being.